Lic Surrender Form Download

- Lic Wealth Plus Surrender Form Download

- Lic Surrender Form 5074 Download Pdf

- Surrender Lic Policy Online

- Lic Surrender Form Download Free

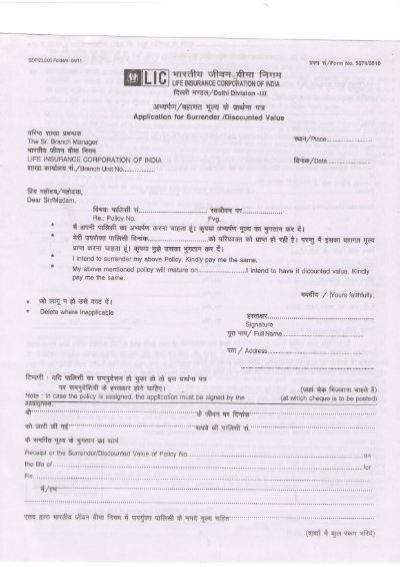

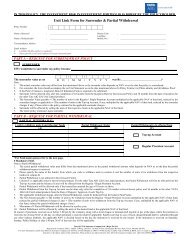

Jasc psp 9 download. LIC New Endowment Plan. The Life Insurance Corporation of India is known as the pioneer of insurance in India. With its wide customer base the LIC is one of the most trusted brand in the insurance sector. PolicyWala.com - Online Insurance, Life Insurance, Car Insurance, Health Insurance, Mediclaim. + Download: LIC Form - 5074 & 3510 - for Surrender Value Report File. Dec 26, 2011 Any Traditional policy of LIC OF INDIA can be surrendered only after 3 years from DOC ( Date of Commencement) of the LIC POLICY. In ordered to surrender the LIC POLICY, the LIC POLICYHOLDER needed to submit the surrender form duly signed by the POLICYHOLDER on the 1st and 2nd page( sign on the. Dec 08, 2018 Download LIC Surrender Form No.5074. LIC Neft Mandate Form. When ever you surrender a policy or getting maturity benefit or during claim settlement, you need to submit LIC Neft Form to get benefit amount by neft. This is the fastest mode to get your benefit amount in your account. This form must be completed before (1) An Advocate (2) An Agent of the Corporation (who is a member of the club at the level of Divisional Manager's Club or above), (3) a Bank Manager, (4) a Block Development Officer, (5) a Commissioner of Oaths, (6) a Doctor, (7) a Gazetted Officer, (8) a Head Master of High School, (9) a Head.

Lic Wealth Plus Surrender Form Download

Lic Surrender Form 5074 Download Pdf

Dilip Lakhani, Senior Chartered Accountant, answers queries from our readers on income tax and other levies.

Surrender Lic Policy Online

I am 65 and retired. My only sources of income are Bank FDs, Post Office Savings, Senior Citizen Savings Scheme, LIC Pension as Annuity (Superannuation Scheme of employer manage by P&GS Dept of LIC ) and savings interest from my bank. My gross annual income for FY 2018-19 is slightly below Rs 6.65 lakh. I have been filing my IT returns for past 24 years and all my IT returns have been assessed and I have received the refunds as may be the case. I understand that for FY 2018-19 (AY2019-20) there is a new IT rule which allows retired senior citizen to claim standard deduction up to Rs 40,000 for any LIC Pension received as annuity amount of pension received from a LIC superannuation scheme from their P&GS section. I receive Rs 32,760 per year, monthly LIC annuity as pension of Rs 2,730 directly into my saving bank account. My bank passbook shows all of the monthly entries for pension received. No TDS is deducted by LIC P&GS Dept. So up till now I used to add this entire pension (taxable) into my gross income to compute tax as per tax slab for the year. I request help and guidance on following: Is it correct that LIC annuity from employer superannuation scheme pension, and this annuity paid by P&GS dept is eligible for standard deduction of maximum Rs 40,000 per year for FY 2018-19? If yes, then how do I claim this standard deduction in my ITR2, should I use the “salaries” section and claim standard deduction? Is it allowed? Also, I have TAN number of the LIC P&GS section which is giving me this monthly pension directly into my savings account. What other documents do I need to have to claim this standard deduction while filing my ITR2 for AY 2019-20? -- SHERRYL GOMES

Standard deduction u/s 16(ia) of IT Act 1961 is available only from the Salary income. As per IT Act Salary includes any annuity or pension received. Annuity received from superannuation scheme started by former employer in discharge of its obligation to pay pension is taxable under the head Salaries. Annuity received by you from LIC superannuation scheme will be taxed under the head Salary income and consequently you will be entitled to claim the standard deduction of Rs 32,760, being the amount chargeable to tax under the head Salary. In the ITR 2 form, you will have to disclose the sum of Rs 32,760 as income under the head salary and consequently claim the standard deduction under the specific head u/s 16(ia). There is no requirement to maintain any other documents to claim the standard deduction.

Please send your queries on Stocks to et.stocks@timesgroup.com; Mutual Funds to et.mfs@timesgroup.com Tax to et.tax@timesgroup.com Insurance to et.insurance@timesgroup.com Realty to et.realty@timesgroup.com